Trick Concepts for Efficiently Managing and Eliminating Financial Debt

While the trip in the direction of financial freedom may show up complicated, adhering to key principles can pave the means for a much more protected and steady future. As we discover the fundamental principles for properly managing financial debt, a roadmap arises-- a roadmap that holds the guarantee of monetary freedom and peace of mind.

Setting Clear Financial Goals

To effectively browse the path in the direction of financial stability, it is crucial to establish clear and quantifiable goals that straighten with your long-term goals. Establishing clear monetary goals supplies a roadmap for managing and removing financial obligation. Begin by examining your existing economic circumstance, including total debt, earnings, expenses, and savings. This examination will help you establish where you stand and where you want to be financially.

In addition, damage down your larger economic goals right into smaller landmarks. Commemorating these achievements can provide a sense of progress and keep you motivated in the direction of the supreme objective of monetary freedom.

On a regular basis evaluation and change your financial goals as required. Life conditions and concerns may alter, calling for alterations to your first plan (hmrc debt management contact number). By staying versatile and dedicated to your objectives, you can efficiently manage and eliminate financial obligation while working towards a much more safe monetary future

Establishing a Realistic Spending Plan

In the trip towards economic security, a crucial action is developing a reasonable spending plan that straightens with your earnings and expenses. Variable expenditures such as grocery stores, enjoyment, and transportation needs to also be accounted for to give a detailed review of your financial obligations.

When you have a clear understanding of your revenue and expenditures, it is crucial to prioritize crucial expenses while identifying areas where you can potentially reduce back to liberate funds for financial debt payment. By setting practical costs limits and tracking your expenses diligently, you can acquire far better control over your funds and work in the direction of removing debt better. Remember, a well-crafted budget plan functions as a roadmap to financial freedom and leads the way for a healthier economic future.

Prioritizing Debt Repayment

Having developed a reasonable budget lining up with your revenue and expenditures, the next important action in accomplishing economic security is focusing on financial debt settlement. Prioritizing debt settlement involves assessing all arrearages and establishing which ones to take on initially. Start by detailing all your financial obligations, including charge card, car loans, and any other quantities owed. Next, classify them based on rate of interest prices, outstanding balances, and settlement terms.

Structure a Reserve

The establishment of a reserve is a basic part of a sound economic plan. An emergency fund works as a safety internet, providing a pillow against unexpected expenses or financial setbacks. Building a reserve entails establishing apart a certain amount of cash that is easily obtainable in times of need, such as medical emergency situations, car repair services, or unexpected work loss. Economists typically recommend having 3 to six months' well worth of living expenses conserved in an emergency situation fund.

Begin by establishing attainable savings objectives and frequently contributing a part of your income to the fund. Take into consideration automating your cost savings by establishing up automatic transfers to your emergency fund account.

Seeking Expert Guidance

With the foundation of a strong emergency situation fund in position, individuals looking for to further enhance their monetary monitoring skills may profit from looking for professional assistance on maximizing their economic strategies. Professional monetary advisors, planners, or counselors can offer beneficial understandings and customized suggestions customized to private conditions. These professionals have the competence to aid people create click this thorough financial plans, set achievable goals, and navigate complicated economic scenarios effectively.

Seeking professional assistance can help with a deeper understanding of various debt management techniques, investment opportunities, and retirement preparation alternatives. Financial specialists can supply unbiased recommendations, aiding people make notified decisions that align with their long-term financial purposes (hmrc debt management contact number). Additionally, they can provide advice on budgeting, financial debt loan consolidation, credit scores administration, and wealth-building techniques, empowering people to make sound economic choices

Final Thought

To conclude, implementing crucial concepts such as setting clear financial objectives, developing a realistic budget plan, prioritizing financial debt repayment, building an emergency situation fund, and looking for specialist assistance are necessary for efficiently managing and eliminating financial obligation. By complying with resource these concepts, people can take control of their funds and work towards a debt-free future. It is essential to remain disciplined and devoted to these strategies in order to attain financial security and freedom.

Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Phoebe Cates Then & Now!

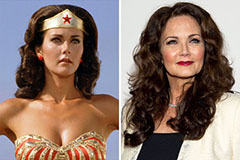

Phoebe Cates Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!